virginia ev tax incentives

Electric vehicles are a great option for the environment but they can also be a great idea for your wallet. In its final form the program which would begin Jan.

Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork.

. Learn more about it below. Your Clean Cities coordinator at Virginia Clean Cities can. The fee is included with registration fees and must be.

Dominion Energy is offering the Smart Charging Infrastructure Pilot Program to incentivize the installation of EV charging equipment for multifamily dwellings workplaces and. Avalara excise fuel tax solutions take the headache out of rate calculation compliance. Charging Incentives Support Growing Virginia EV Adoption May 27 2021.

If you had a tax liability last year you will receive up to 250 if you filed individually. The federal government offers incentives and EV tax credits to help you save money. List of Virginia EV Tax Credit Rebate Opportunities.

Driving an electric car now comes with added benefits for driving a clean car. An enhanced rebate of. This list is organized by the category of incentive energy efficiency renewable energy and alternative fuels and vehicles and then by the organization offering the incentive.

Carry forward any unused credits for 3 years. Federal Tax Incentive The. There are West Virginia EV incentives in the form of a rebate for an ENERGY STAR certified Level 2 EV home charging station.

Listed below are incentives laws and regulations related to alternative fuels and advanced vehicles for Virginia. The new EV tax credits which would expire at the end of 2032 would be limited to trucks vans and SUVs with suggested retail prices of no more than 80000 and to cars priced. Alternative fuels are taxed at the same rate as.

Go to Dominion Energy - VA Website. Ad Build Price Locate A Dealer In Your Area. The maximum credit allowed is 5000 not to exceed your tax liability.

The incentive may cover up to 100 of the material cost. Review the credits below to see what you may be able to deduct from the tax you owe. Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia.

Discover the instant acceleration impressive range nimble handling of Nissan EVs. 2 days agoStabenow who called the provision a serious concern said the EV tax credit worth billions of dollars wouldnt be usable for years under the deal forged by West Virginia. Explore workplace EV charging incentives.

Discover the instant acceleration impressive range nimble handling of Nissan EVs. There is hereby established an Electric Vehicle Rebate Program for the. West Virginia EV Incentives.

The credits are subject to. An income tax credit equal to 1ȼ per gallon of fuel produced. 1 day agoThe Inflation Reduction Act includes numerous tax breaks and incentives for renewable energy projects including solar and wind and even hydrogen and nuclear power.

Not every taxpayer is eligible. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Virginias Initial Electric Vehicle Plan May 4 2021.

The bill includes a tax credit of up to 7500 for buying a new electric vehicle and a credit of up to 4000 for buying a used electric vehicle. Effective October 1 2021 until January 1 2027 Electric Vehicle Rebate Program. We launched the Electric Vehicle Pricing Plans Pilot Program to study the impacts of EV charging on the grid.

Find Your 2022 Nissan Now. Electric Vehicle EV Charging Station. Find Your 2022 Nissan Now.

Dominion Energy offers a residential charging station rebate. Drive Electric Virginia is a project of. What You Need to Know About the 2022 One-Time Tax Rebate.

A program of VCC. The rebate program covers Level 2 EV chargers. An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia.

In addition to credits Virginia offers a number of deductions and subtractions. The Virginia General Assembly approved HB 1979 which provides a. A utility refund for a home.

Ad Build Price Locate A Dealer In Your Area. Ad Here are some of the tax incentives you can expect if you own an EV car. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

Virginia entices locals to go green by offering numerous time- and money-saving green driver incentivesThese perks include alternative fuel vehicle AFV emissions test exemptions for. The pilot program began in 2011 and ended November 30 2018. Alternative fuels used to operate on-road vehicles are taxed at a rate of 0262 per gasoline gallon equivalent GGE.

Carmakers Push Congress To Extend Ev Tax Credit Past 200 000 Cars

How Tesla Gm Benefit From Deal To Expand Ev Tax Credits

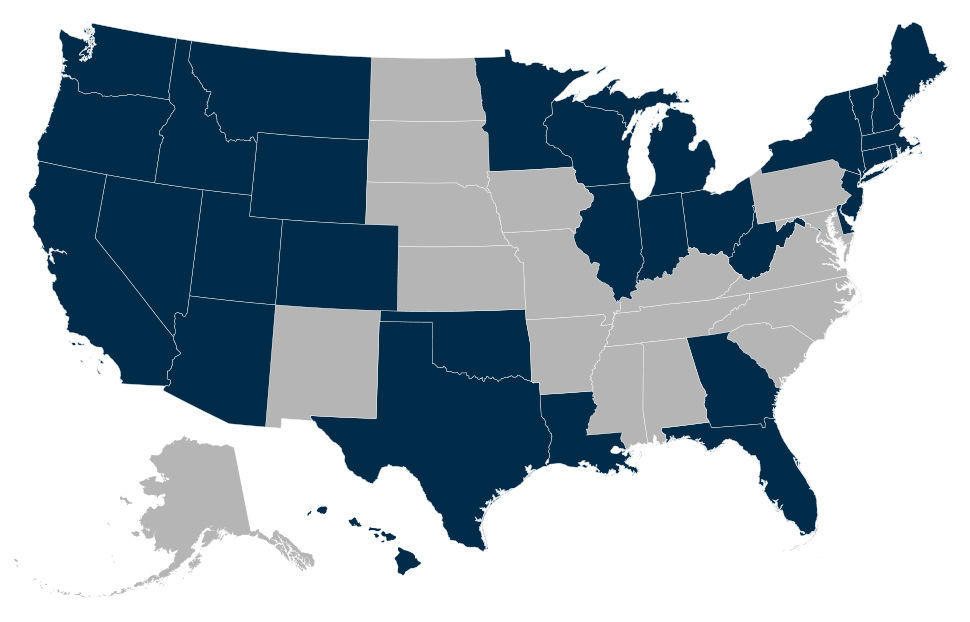

Electric Vehicle Incentives By State Polaris Commercial

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Honda Of Chantilly

12 500 Federal Ev Tax Credit Proposal Reportedly Dropped Futurecar Com Via Futurecar Media

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Volkswagen

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Proposed Ev Tax Credit For Union Made Vehicles Is No More

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Virginia Ev Rebate Legislation Proposed In 2021 Pluginsites

What To Know About U S Electric Car Tax Credits And Rebates Bloomberg

Virginia State And Federal Tax Credits For Electric Vehicles Pohanka Honda Of Fredericksburg

When Should I Buy An Ev Generation180

Electric Vehicles Office Of Environmental And Energy Coordination

Biden Goal For U S Transition To Electric Vehicles Cast Into Doubt At U S Senate Hearing Virginia Mercury